Payroll deductions online calculator 2023

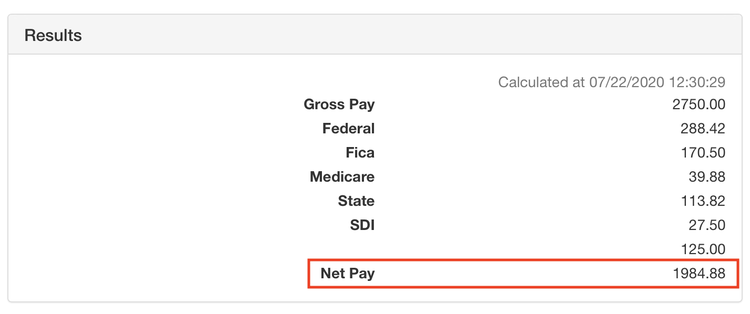

About the US Salary Calculator 202223. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

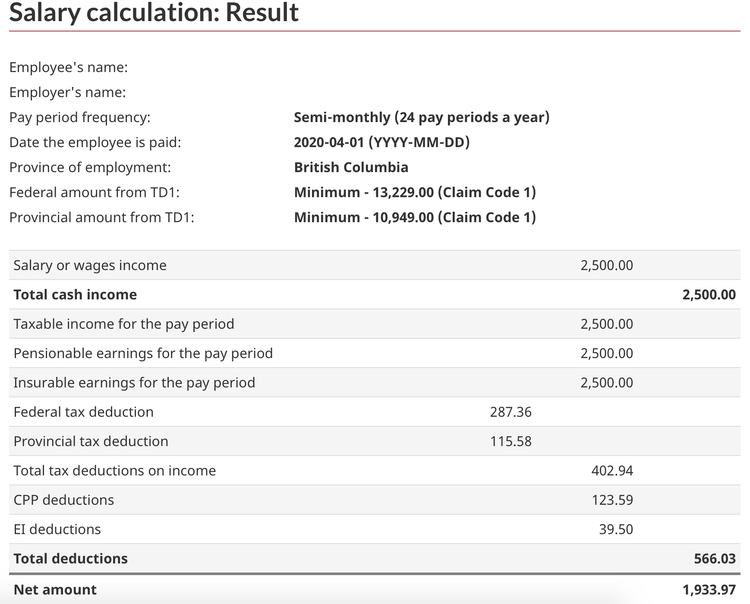

How To Do Payroll In Canada A Step By Step Guide

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

. 2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. Use our employees tax calculator to work out how much PAYE and UIF tax. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Employers and employees can use this calculator to work out how much PAYE. The maximum an employee will pay in 2022 is.

The US Salary Calculator is updated for 202223. Free Unbiased Reviews Top Picks. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings.

Choose Your Payroll Tools from the Premier Resource for Businesses. And is based on the tax brackets of 2021 and. This free hourly and salary paycheck calculator can estimate an employees net pay.

2023 Paid Family Leave Payroll Deduction Calculator. For example if you earn 2000week your annual income is calculated by. Subtract 12900 for Married otherwise.

Paycheck after federal tax. All Services Backed by Tax Guarantee. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Get Started With ADP Payroll. Use our employees tax calculator to work out how much PAYE and UIF tax you. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization. Subtract 12900 for Married otherwise. It will confirm the deductions you.

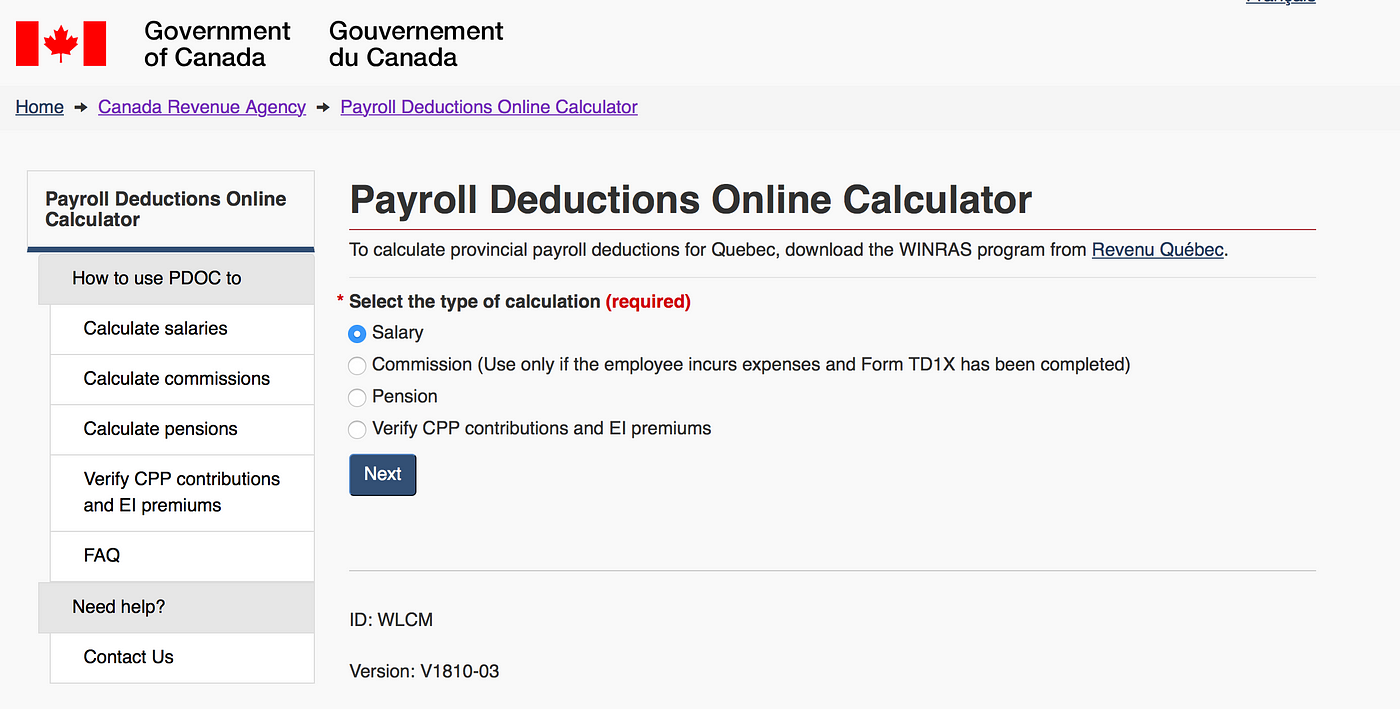

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Free Unbiased Reviews Top Picks. Form TD1-IN Determination of Exemption of an Indians Employment Income.

See Why 30000 Organizations Trust Paycor for their HR and Payroll Needs. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Deductions from salary and wages.

Ad Plus 3 Free Months of Payroll Processing. In case you got any Tax Questions. Use our PAYE calculator to work out salary and wage deductions.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. Payroll Deduction Calculator Calculating payroll deductions doesnt have to be a headache. Prepare and e-File your.

Ad Plus 3 Free Months of Payroll Processing. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Get Started With ADP Payroll. Under 65 Between 65 and 75 Over 75.

The Tax withheld for individuals calculator is. 2022 Federal income tax withholding calculation. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. It will be updated with 2023 tax year data as soon the data is available from the IRS. Subtract 12900 for Married otherwise.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Sage Income Tax Calculator. Get Started With ADP Payroll.

Ad Compare This Years Top 5 Free Payroll Software. Ad Get the Payroll Tools your competitors are already using - Start Now. Daily Weekly Monthly Yearly.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown. It can also be used to help fill steps 3. The payroll tax rate reverted to 545 on 1 July 2022.

Discover ADP Payroll Benefits Insurance Time Talent HR More. 2022 Federal income tax withholding calculation.

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

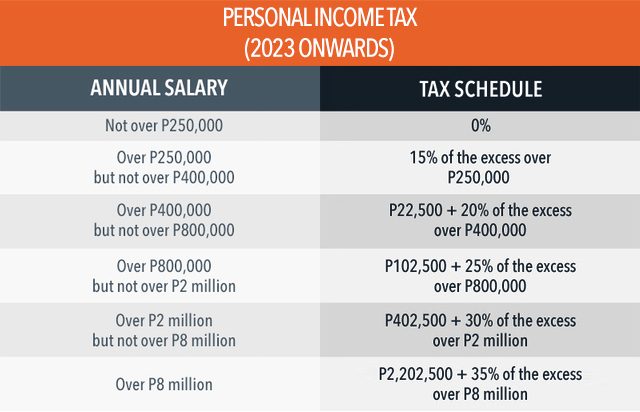

Tax Calculator Compute Your New Income Tax

A Small Business Guide To Doing Manual Payroll

Payroll Tax Vs Income Tax What S The Difference

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Paycheck Tax Withholding Calculator For W 4 Tax Planning

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Salary Calculator With Taxes Clearance 51 Off Pwdnutrition Com